Introduction

Mobile Money is a form of electronic transfer that allows customers to send or receive money via their mobile phones. Mobile phones have become an integral part of the lives of many people in developing countries and have been utilized as a tool for financial inclusion, particularly in Africa.

Mobile Money transfers are typically conducted through an agent who takes the customer’s cash and credits the customer’s Mobile Money account with the corresponding amount. This system enables users to perform financial transactions without the need for a traditional bank account, promoting greater accessibility and convenience.

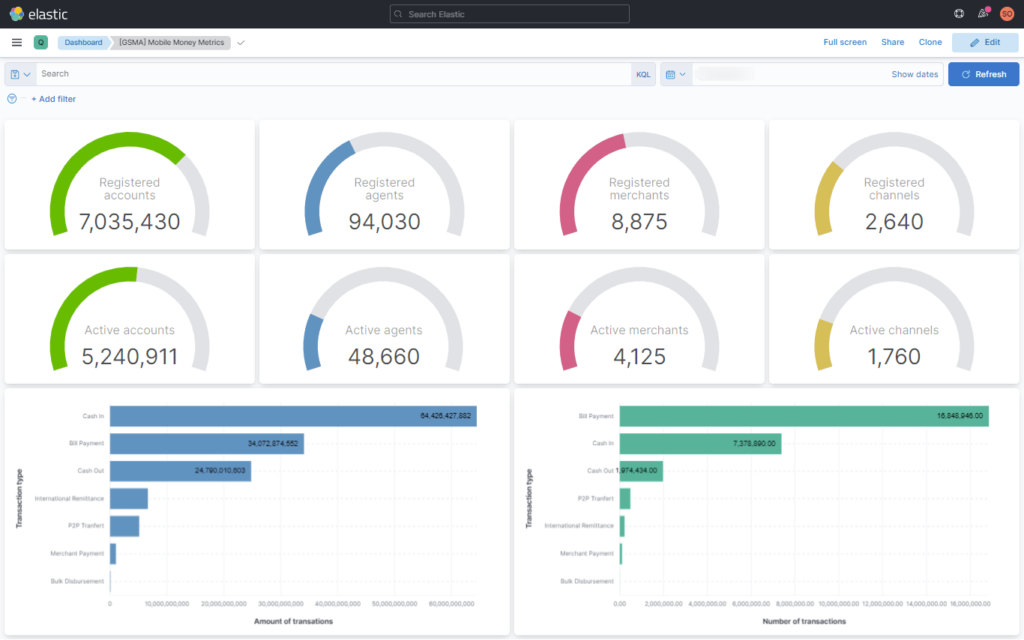

Key Metrics for Measuring Mobile Money Activity

Metrics are essential for evaluating a company’s performance against its objectives. They are often considered qu antifiable measures that, when compared to historical data, can indicate whether a company is trending positively or negatively toward its goals. Below are some key metrics we use to understand and measure our clients’ data, helping them achieve their objectives:

Registered Accounts: The total number of customer accounts registered with the Mobile Money service. This metric excludes customers who perform over-the-counter (OTC) transactions without registering an account. In some Mobile Money services, especially those primarily offering OTC transactions, agents facilitate transactions on behalf of customers who do not hold a formal Mobile Money account.

Tracking registered accounts helps in assessing the user base’s growth and the penetration of digital financial services within the target population.

With the increasing push for digital financial inclusion, many regions are seeing a surge in registered accounts as governments and financial institutions promote account registration through incentives and regulatory requirements.

Active Accounts: The number of customer accounts that have been used to send or receive payments, make withdrawals, transfer funds to bank accounts, or make purchases using mobile commerce services within the last 90 days of the previous year.

Active accounts are a crucial indicator of user engagement and the ongoing utilization of Mobile Money services. High numbers of active accounts suggest that users find the service valuable and continue to integrate it into their daily financial activities.

The trend towards increased smartphone usage and improved network coverage has contributed to higher engagement rates, resulting in more active accounts as users leverage additional Mobile Money functionalities like bill payments and mobile savings.

Registered Agents: The number of agents registered to provide deposit and withdrawal services by the end of the year.

Agents are the backbone of the Mobile Money ecosystem, facilitating cash-in and cash-out transactions. Monitoring the number of registered agents helps assess the network’s reach and accessibility, ensuring that customers can easily access their funds.

Expansion of agent networks in rural and underserved areas continues to be a focus, driven by partnerships between Mobile Money providers and local businesses to enhance financial inclusion.

Active Agents: Agents who have conducted at least one transaction in the past 30 days, up to the end of the specified year.

Active agents indicate the operational health and reliability of the Mobile Money network. High numbers of active agents ensure that customers have consistent access to services and that the network remains robust and responsive to user needs.

Enhanced training programs and performance incentives for agents have led to increased activity levels, improving service reliability and customer satisfaction.

Person-to-Person (P2P) Transfers: Simple fund transfers between Mobile Money accounts, initiated and completed by the two parties involved.

P2P transfers are a fundamental feature of Mobile Money services, enabling users to send money to friends, family, or business associates quickly and securely. This metric reflects the platform’s utility for everyday financial interactions.

Integration with social media platforms and enhanced security features have made P2P transfers more seamless and secure, driving higher usage rates.

International Remittances: Cross-border transfers of funds from one person to another, either directly from a Mobile Money account or through intermediaries like Western Union.

International remittances are vital for many users who rely on money sent from abroad to support their families. This metric highlights the service’s role in facilitating global financial connectivity and economic support.

Increased regulatory support and partnerships with international financial institutions have streamlined cross-border transactions, reducing costs and increasing transaction volumes.

Bill Payments: Payments made from a Mobile Money account to a bill issuer or billing organization in exchange for goods and services.

Bill payments represent a significant use case for Mobile Money, allowing users to pay utilities, rent, and other recurring expenses conveniently from their mobile devices. This metric demonstrates the platform’s integration into users’ routine financial activities.

Expansion of bill payment options to include a wider range of services, such as education fees and healthcare payments, has further embedded Mobile Money into essential financial transactions.

Merchant Payments: Payments made to retail or online merchants in exchange for goods or services using a Mobile Money account or platform.

Merchant payments indicate the adoption of Mobile Money as a preferred payment method for both online and offline purchases. This metric reflects the service’s acceptance among businesses and its role in facilitating commerce.

Growth in e-commerce and partnerships with major retailers have significantly boosted merchant payment transactions, enhancing the overall ecosystem’s vibrancy.

Bulk Disbursements: Payments such as salaries, reimbursements, or other large-scale disbursements sent directly to a user’s Mobile Money account via phone codes or SMS.

Bulk disbursements simplify the process of distributing large sums of money to multiple recipients efficiently and securely. This metric is crucial for understanding how Mobile Money is utilized for organizational payments and financial management.

Increased adoption by employers and government agencies for payroll and social welfare programs has driven higher volumes of bulk disbursements, showcasing the platform’s scalability and reliability.

Cash-In: Depositing cash into a customer’s Mobile Money wallet through an agent.

Cash-in transactions are fundamental for users to load their Mobile Money accounts with funds. This metric measures the ease and frequency with which users can add money to their digital wallets.

Innovations such as instant cash-in via mobile apps and expanded agent networks have made depositing funds more convenient, increasing transaction volumes.

Cash-Out: Withdrawing cash from a customer’s Mobile Money account, facilitated by an agent.

Cash-out transactions allow users to convert their digital funds back into physical cash, providing flexibility and ensuring that Mobile Money remains a versatile financial tool.

Enhanced withdrawal options, including ATM integrations and partnerships with retail outlets, have broadened access to cash-out services, driving higher usage rates.

The Importance of Monitoring Mobile Money Metrics

Understanding and tracking these metrics is essential for assessing the performance, growth, and impact of Mobile Money services. By analyzing these indicators, Mobile Money providers can identify trends, optimize operations, enhance user experience, and implement targeted strategies to drive financial inclusion.

Introducing S-ONE MFS

To effectively monitor and analyze Mobile Money metrics, Synaptique offers S-ONE MFS, an advanced Mobile Financial Services monitoring solution. S-ONE MFS leverages cutting-edge technology AI and Machine learning to provide real-time insights and comprehensive analytics, enabling telecom operators and financial institutions to detect and prevent fraudulent activities, optimize service performance, and enhance user satisfaction.

Our solution offers:

- Real-Time Monitoring: Continuously track transactions and user activities to identify anomalies and potential fraud.

- Comprehensive Analytics: Gain deep insights into transaction patterns, user behavior, and service utilization.

- Customizable Dashboards: Visualize key metrics and performance indicators tailored to your specific needs.

- Automated Reporting: Generate detailed reports to support decision-making and strategic planning.

- Enhanced Security: Protect your Mobile Money ecosystem with robust security measures and fraud detection capabilities.

Download our brochure to learn more about how S-ONE MFS can revolutionize your Mobile Money monitoring and analytics.